Risk Assessment

Holistic Risk Visibility

End-to-end inherent & residual risk assessment methodology. Comprehensive evaluation of money laundering and terrorist financing threats.

Identifying and Mitigating Threats

An Enterprise-Wide Risk Assessment (EWRA) is the cornerstone of any AML program. We help you identify inherent risks across customers, products, channels, and geographies, and evaluate the effectiveness of your controls to determine residual risk.

The Foundation of Compliance

The UAE AML Law explicitly mandates that all Financial Institutions and DNFBPs must identify, assess, and understand their ML/TF risks. The Enterprise-Wide Risk Assessment (EWRA) is not just a document; it is the mathematical logic that defines your entire compliance program.

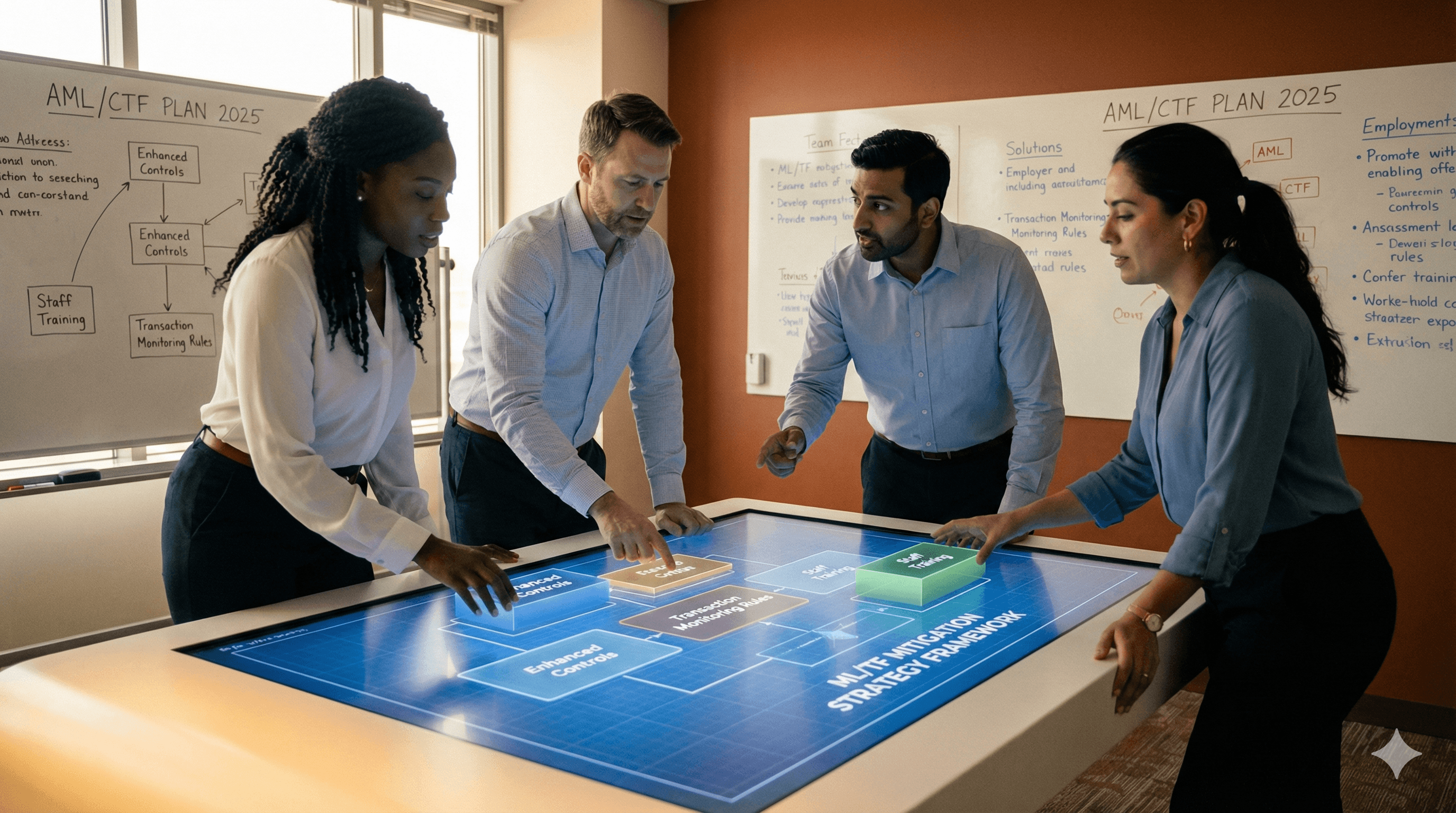

If you don't know where your risks are, you cannot mitigate them. Zeej helps you build a scientific, data-driven EWRA that calculates risk across four key pillars: Customers, Products/Services, Delivery Channels, and Geographies.

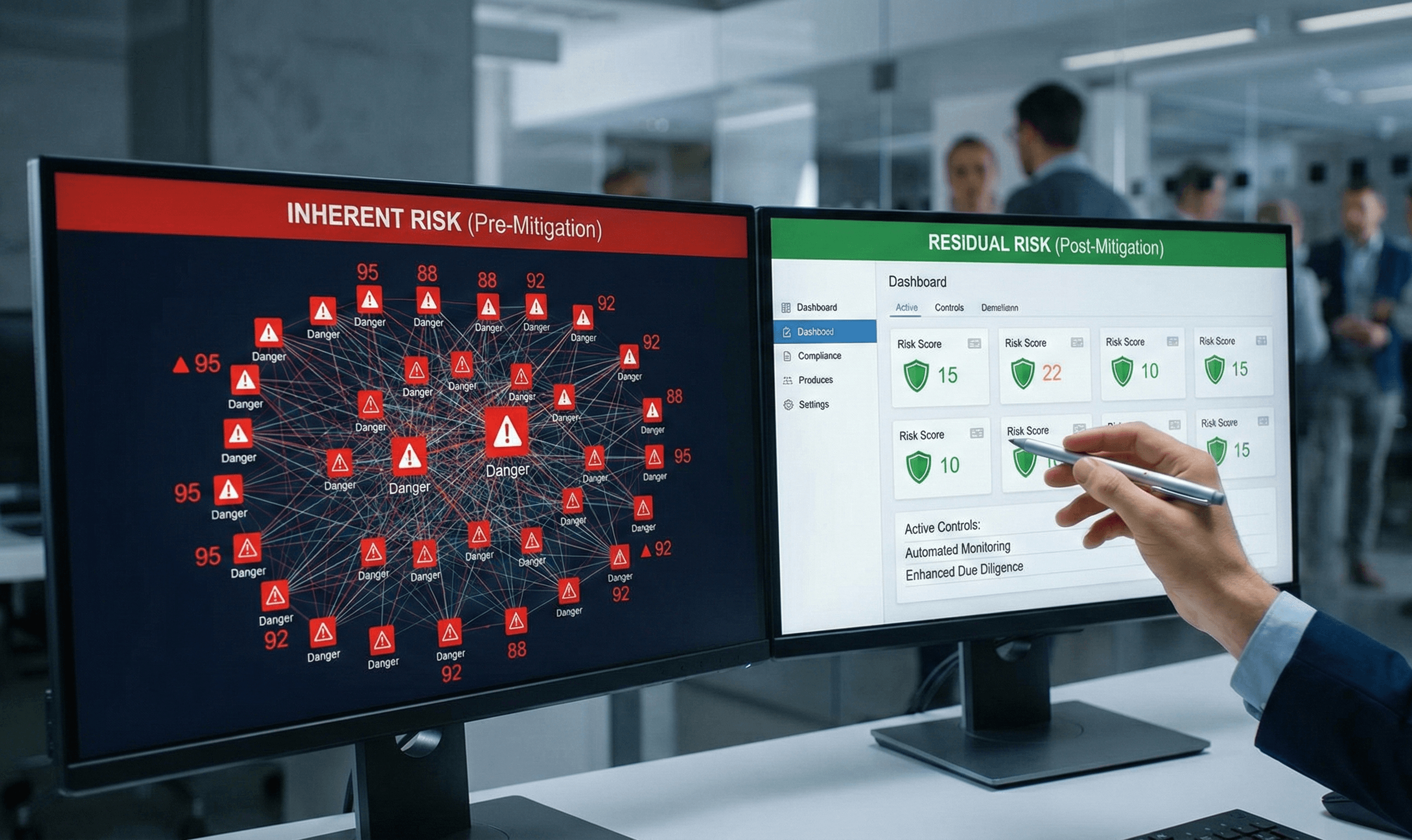

Inherent vs. Residual Risk

We use a robust methodology to calculate 'Inherent Risk' (risk before controls) and then assess the strength of your 'Mitigating Controls' (policies, systems, staff). The result is your 'Residual Risk'.

This approach allows you to demonstrate to regulators exactly why you classified a specific segment as High or Low risk. It turns subjective guessing into objective, defensible data.

Dynamic & Living Assessment

A Risk Assessment is never 'finished'. It must be a living document that evolves with your business. We build dynamic EWRA models (Excel or System-based) that you can update as your business grows.

We also help you link your EWRA methodology to your Customer Risk Assessment (CRA), ensuring that your macro-level risk appetite is reflected in micro-level customer onboarding decisions.

Execution Roadmap

A structured, transparent roadmap tailored to your compliance journey.

Context Establishment

Defining the scope and context of the organization.

Inherent Risk ID

Identifying risks in customers, products, and channels.

Data Analysis

Reviewing transaction volumes and customer demographics.

Control Inventory

Mapping existing controls to identified risks.

Control Testing

Evaluating the design and effectiveness of controls.

Residual Risk Calc

Determining net risk levels after controls are applied.

Action Plan

Developing mitigation strategies for high residual risks.

Board Approval

Presenting findings and heatmap to the Board/Senior Management.

Key Features & Benefits

Custom Methodology

Tailored risk scoring models specific to your industry.

Heatmaps

Visual representation of risk concentrations.

Regulatory Alignment

Ensuring the assessment meets specific UAE/CBUAE requirements.

Service FAQs

Yes. Federal Decree-Law No. (20) requires all regulated entities to identify and assess their risks. Lack of an EWRA is a primary finding in almost all Ministry inspections.