Due Diligence

Know Your Customer with Confidence

Risk-based due diligence for customer onboarding & monitoring. We handle Identity Verification, UBO Unwrapping, and Enhanced Due Diligence for high-risk entities.

Deep Dive Due Diligence

Our specialized team conducts thorough KYC, CDD, and EDD reviews. We don't just tick boxes; we analyze the risk profile of each customer, ensuring you understand who you are doing business with and preventing financial crime risks.

Beyond the Checkbox

KYC (Know Your Customer) is more than just collecting a passport copy. It is about understanding the 'Nature and Purpose' of the business relationship. We help you build a customer profile that makes sense.

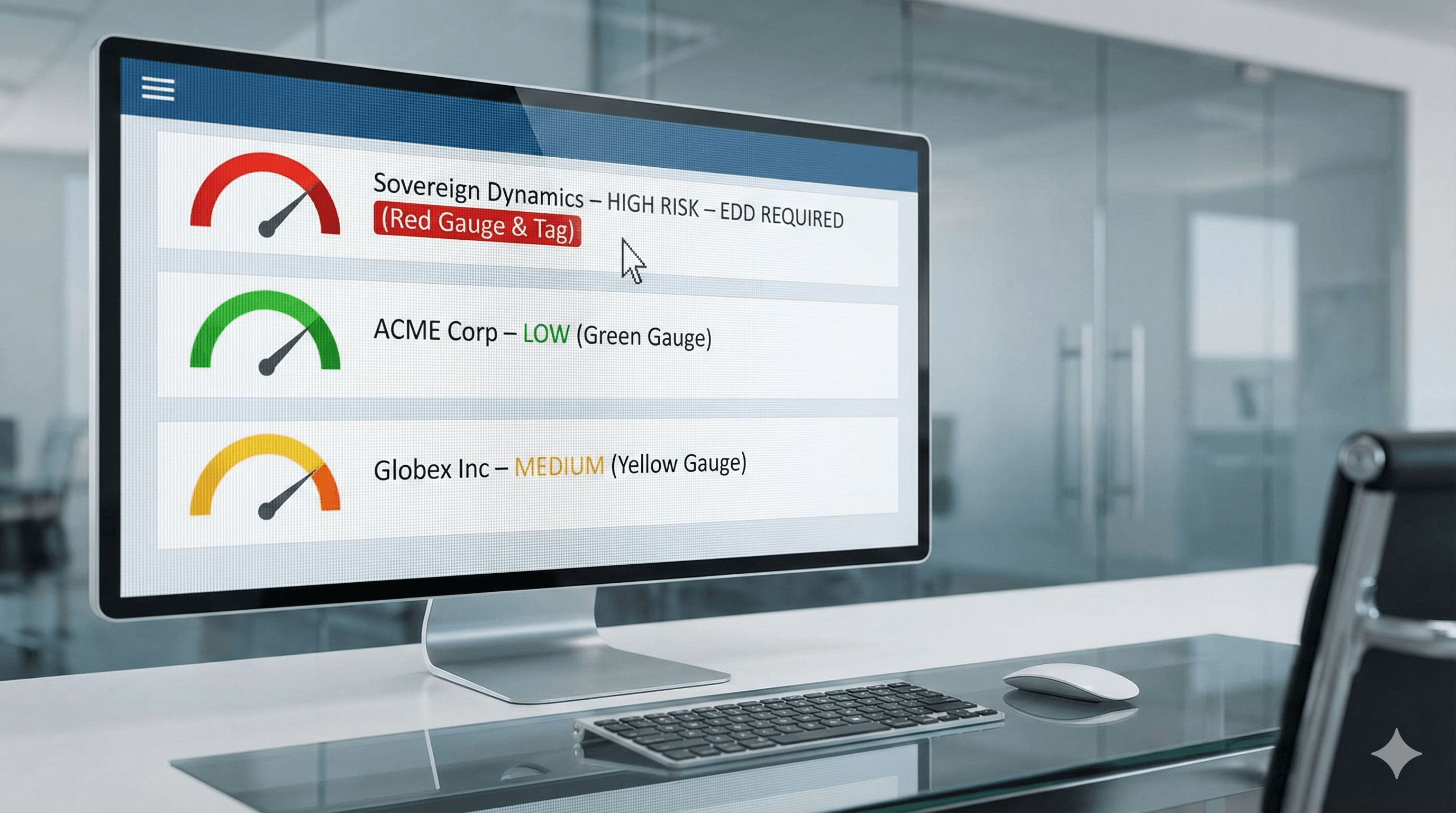

Our methodology focuses on the 'Risk-Based Approach'. A low-risk salaried individual requires a different level of diligence compared to a high-net-worth individual involved in cross-border trade. We configure your CDD processes to apply resources where risks are highest.

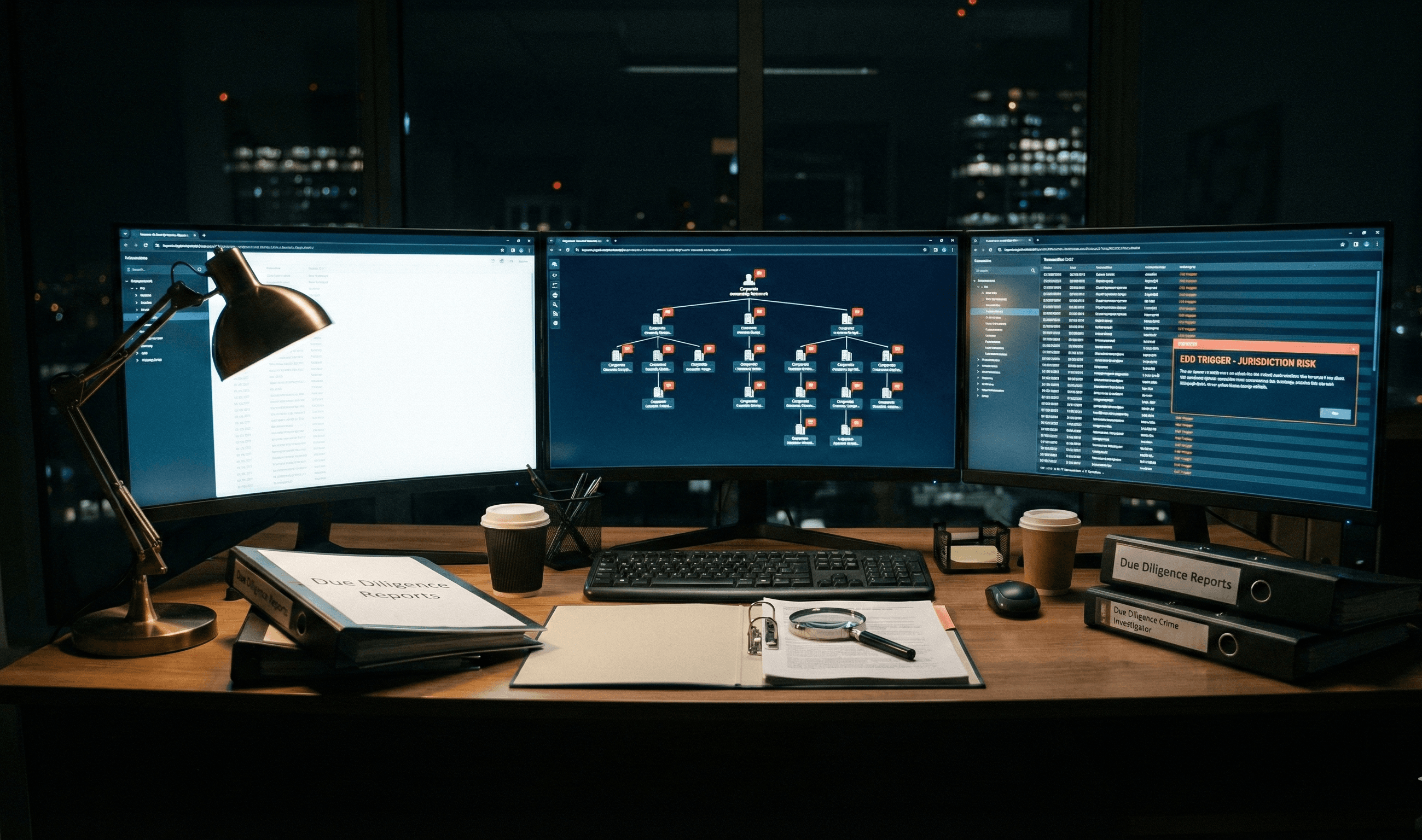

Ultimate Beneficial Ownership (UBO)

Identifying the UBO is one of the biggest challenges in the UAE. Shell companies and complex ownership structures can hide the true controllers. Zeej specializes in 'UBO Unwrapping'.

We trace ownership layers through corporate registries to identify the natural persons who ultimately own or control 25% or more of the entity. We also identify controllers by other means, ensuring full compliance with Cabinet Decision No. (58) of 2020.

Enhanced Due Diligence (EDD)

For high-risk customers, Politically Exposed Persons (PEPs), or clients from high-risk jurisdictions, Standard Due Diligence is not enough. We conduct deep-dive EDD.

This involves establishing the Source of Wealth (SoW) and Source of Funds (SoF), commissioning independent background reports, and conducting adverse media analysis to build a comprehensive risk narrative for Senior Management approval.

Execution Roadmap

A structured, transparent roadmap tailored to your compliance journey.

Data Collection

Gathering ID, corporate docs, and UBO information.

Identity Verification

Authenticating documents against official registers.

Screening

Running names against sanctions, PEP, and adverse media lists.

Risk Scoring

Calculating initial risk rating based on dynamic factors.

Enhanced Due Diligence

Deep-dive research for high-risk or complex entities.

Source of Wealth

Verifying origin of funds and wealth for high-risk cases.

Compliance Approval

Final review and sign-off by compliance officers.

Ongoing Monitoring

Setting periodic review schedules and trigger events.

Key Features & Benefits

Risk-Based Screening

Tailored screening depth based on customer risk profile.

UBO Identification

Unraveling complex corporate structures to find ultimate owners.

EDD Reports

Detailed intelligence reports for high-risk relationships.

Service FAQs

CDD (Customer Due Diligence) is the standard process of verifying identity and risk. EDD (Enhanced Due Diligence) is a deeper investigation required for high-risk customers, involving SoW/SoF verification and senior management approval.