Independent Audit

Objective Compliance Assurance

Independent audit with detailed compliance gap reporting. We identify gaps, assess controls, and provide actionable recommendations.

Testing Your Defenses

Our independent AML audits provide a rigorous, objective assessment of your compliance program. We go beyond checkbox ticking to test the actual effectiveness of your monitoring systems, policy adherence, and staff knowledge.

Why Independence Matters

An audit cannot be effective if you grade your own homework. The AML Law requires the audit function to be 'Independent'—meaning it must be performed by a party separate from the compliance function.

Zeej provides this critical Third Line of Defense. We bring a fresh, expert pair of eyes to scrutinize your controls, ensuring you are ready before the regulator knocks on your door.

Mock Inspection Approach

We conduct our audits using the same methodologies as the Ministry of Economy or Central Bank inspectors. We ask the tough questions, request the granular evidence, and test the systems exactly as they would.

This 'Mock Inspection' style means our Final Audit Report serves as a roadmap to bulletproof your compliance program. We identify gaps (observations) and rate them by severity (High/Medium/Low) so you can prioritize fixes.

Comprehensive Scope

Our audit covers the entire compliance universe: Governance & Board Oversight, EWRA Adequacy, Policy Design vs. Execution, KYC/CDD File Quality, Transaction Monitoring System (TMS) Effectiveness, Sanctions Screening capability, and STR Reporting quality.

We don't just look at papers; we look at data. We sample test live transaction alerts to ensure your system is actually catching what it is supposed to catch.

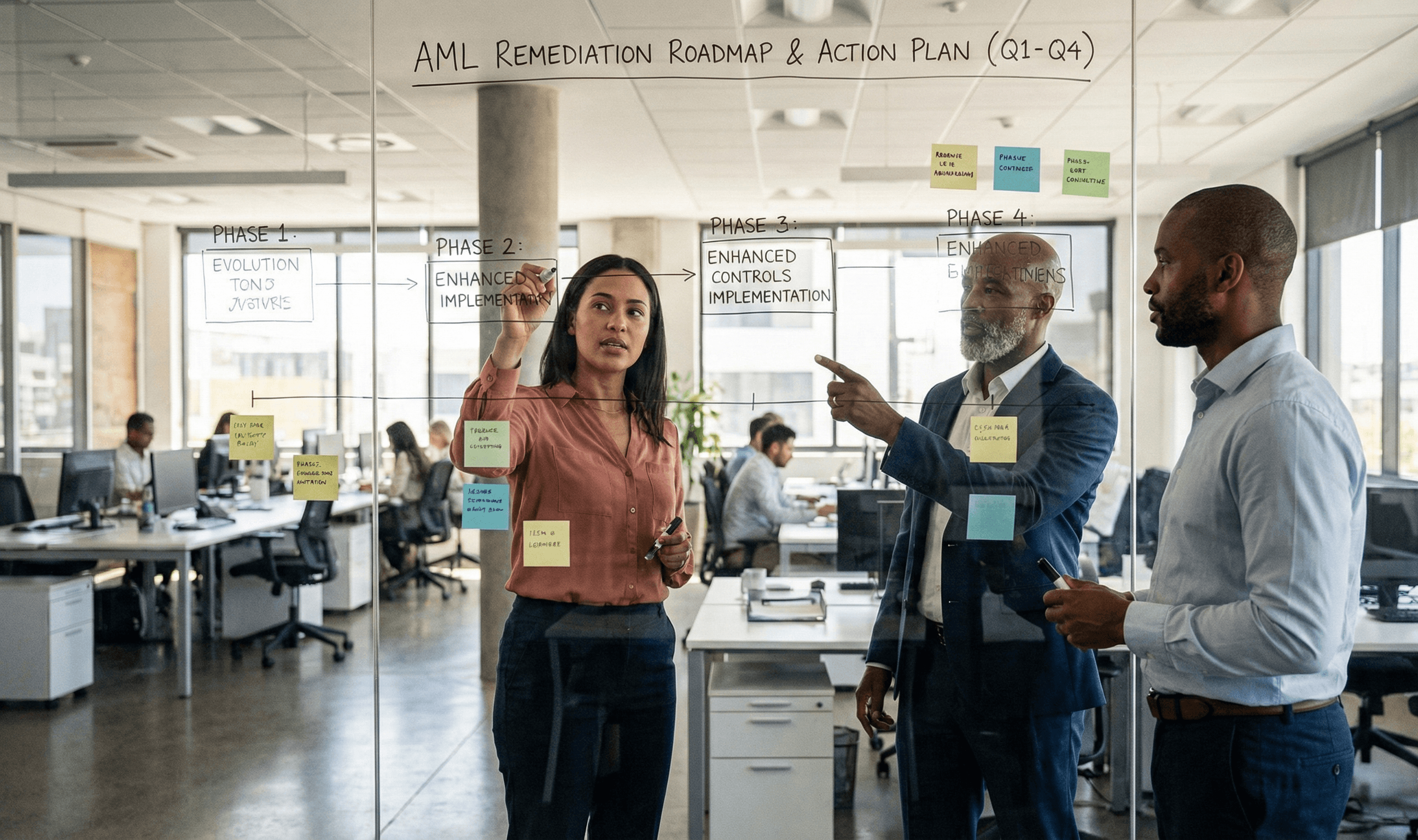

Execution Roadmap

A structured, transparent roadmap tailored to your compliance journey.

Scoping & Planning

Defining audit scope and requesting initial documents.

Walkthroughs

Interviewing staff to understand process flows.

Sample Testing

Selecting files/transactions for detailed testing.

System Validations

Testing screening and monitoring system parameters.

Gap Analysis

Identifying deviations from policies and regulations.

Draft Reporting

Documenting findings and risk ratings.

Management Response

Discussing findings and agreeing on remediation plans.

Final Report

Issuing the formal audit report for the Board and Regulators.

Key Features & Benefits

Governance Review

Assessing board oversight and culture.

Transaction Testing

Data-based testing of alert generation and disposition.

Remediation Logic

Practical, prioritized roadmap for fixing issues.

Service FAQs

Best practice and regulatory expectation is an annual independent audit. For high-risk entities or larger firms, more frequent thematic reviews may be required.