Risk Advisory

Holistic Risk Frameworks

Conducting Enterprise-Wide and Customer Risk Assessments to identify ML/TF/PF risks.

Strategic Risk Evaluation

We conduct comprehensive Enterprise-Wide Risk Assessments (EWRA) and Customer Risk Assessments (CRA) to identify, assess, and document risks related to money laundering, terrorist financing, and proliferation financing (ML/TF/PF). Our approach includes evaluating inherent and residual risks, reviewing the effectiveness of existing controls, and identifying potential gaps. We provide practical, actionable recommendations to strengthen the Client’s risk-based AML/CFT/CPF framework, enhance compliance with UAE regulatory requirements, and support informed decision-making by senior management and the board.

Execution Roadmap

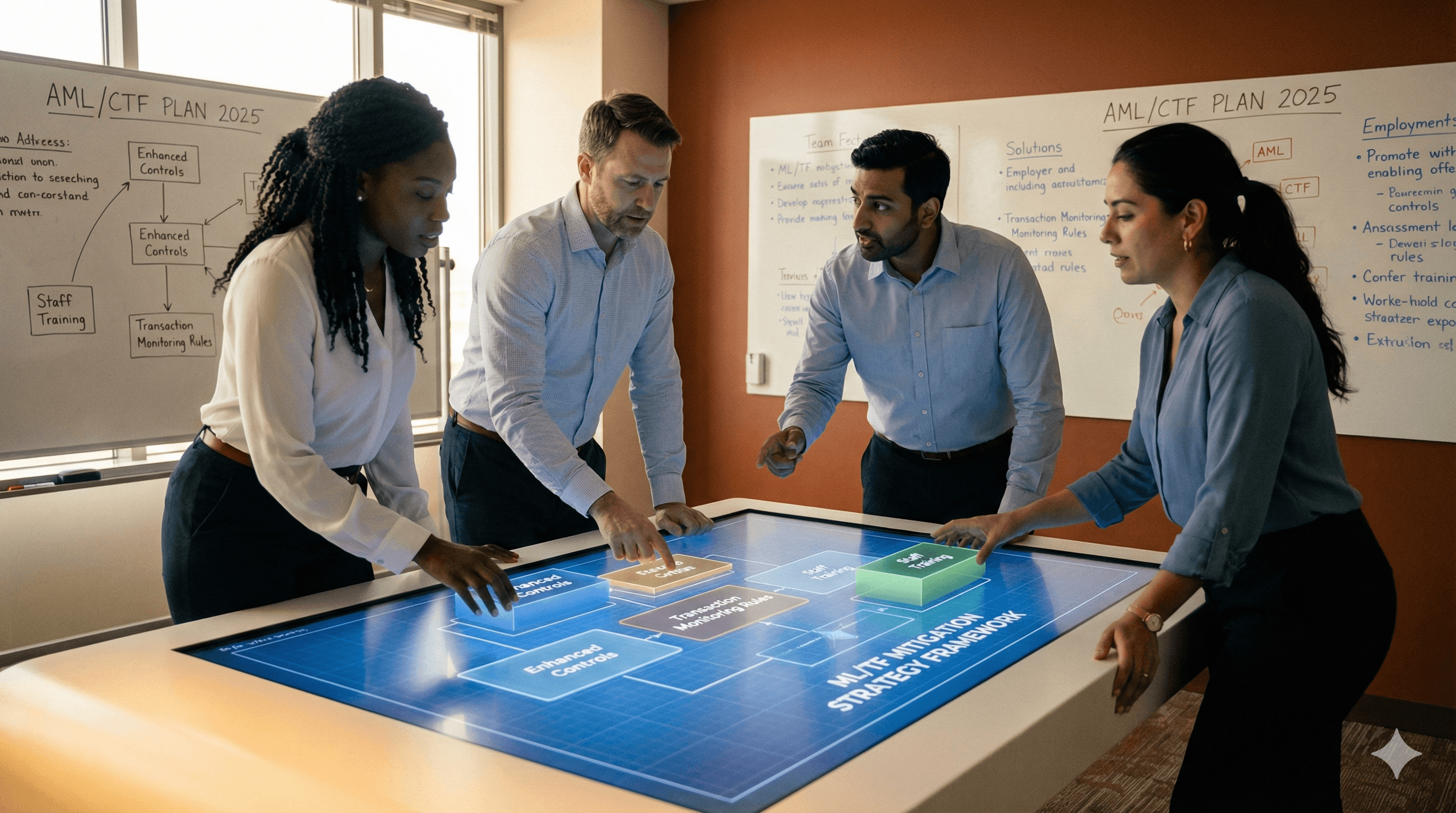

A structured, transparent roadmap tailored to your compliance journey.

Risk Identification

Mapping all potential risk vectors.

CRA Methodology

Defining customer risk scoring logic.

Control Gap Analysis

Identifying weaknesses in defenses.

Recommendations

Actionable steps to reduce risk.

Key Features & Benefits

Ready to Elevate Your

Risk Advisory?

Join the industry leaders who trust Zeej Strategic Consultancy for their compliance needs.